Japan

Wood Products Prices

Dollar Exchange Rates of 10th

June

2025

Japan Yen 144.20

Reports From Japan

US tariffs continue to disrupt trade

Japan's exports fell in the first 20 days of May as sweeping

US tariffs continued to disrupt trade. May exports,

measured by value, dropped 3% year on year according to

the Ministry of Finance. That compared with a 2.3% rise

in the first 20 days of April and a 2.0% rise for all of of

April. Japan's trade balance for the period was in deficit

for around US$8 billion.

See:https://www.japantimes.co.jp/business/2025/06/06/economy/

early-may-japan-exports-drop/

‘Real’wages declined for a fourth consecutive month

The latest data shows real wages in Japan declined for a

fourth consecutive month in April according to the

Ministry of labour as pay increases continued to fall

behind price rises.

On an inflation-adjusted basis, wages were down 1.8% in

April year on year with the inflation figure for that month

estimated at 4.1%. Households are suffering from rising

food prices, especially for rice prices which were up 98%

year on year in April.

The government has been pushing for pay hikes to support

consumer spending, a key driver of economic growth,

recently setting a goal of achieving real wage growth of

around 1 percent across Japan, including through massive

public-private investment, by fiscal 2029.

See:

https://mainichi.jp/english/articles/20250605/p2g/00m/0bu/0160

00c

In recognition of the issue of slow wage growth the

government has highlighted wage increases as a

cornerstone of its economic growth strategy according to a

draft of its planned basic policy on economy, public

finances and reform.

In a draft presented to the Council on Economic and Fiscal

Policy, wage increases are a key part of its growth

strategy.

See: https://www.nippon.com/en/news/yjj2025060601091/

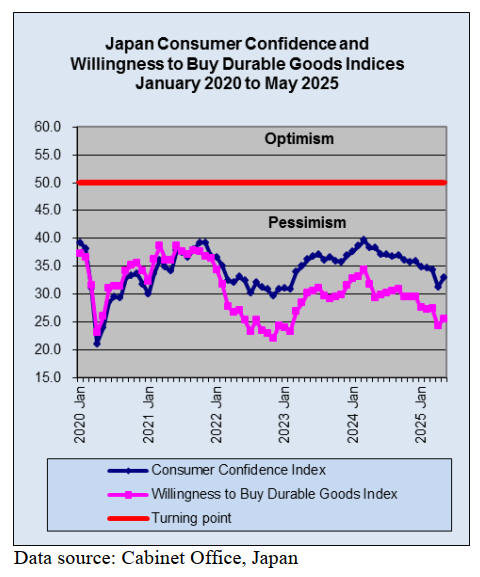

Inflation deters discretionary spending

Household spending declined in April as inflation deterred

discretionary spending. Outlays by households, adjusted

for inflation, fell 0.1% from a year earlier according to the

Ministry of Internal Affairs and Communications. The

decline was led by health care and miscellaneous

spending, while outlays jumped almost 11% for housing.

The importance of consumer spending as an engine of

growth in Japan has increased as US tariffs have dented

export prospects.

Domestic demand will likely be a key factor in

determining whether Japan can avoid a technical recession

after the economy shrank in the first quarter 2025.

See:

https://www.japantimes.co.jp/business/2025/06/06/economy/japa

n-household-spending-falls/

Births at historical low

Japan's fertility rate declined in 2024 for the ninth

consecutive year, reaching another historical low that

underscores the immense challenge facing the government

as it attempts to reverse the trend in one of the world’s

most aged societies.

The total number of births dropped to about 686,000

marking the first time the figure has fallen below 700,000

extending the run of annual declines in the country’s

population to 18 years. The data exclude migration.

The data underscore the urgency of the government’s

recent push to boost fertility which include a range of

policies aimed at easing the financial burden on families.

The government has also guaranteed full wage

compensation for some couples who both take parental

leave. Also the government has promoted improved

working conditions for childcare and nursing staff.

The continued decline in births is renewing concern over

the future of Japan’s social security system. The nation’s

public pension programme is under increasing strain with

fewer contributors and a growing number of recipients.

Over the past two decades, the number of people paying

into the system has fallen by around 3 million, while

beneficiaries have increased by nearly 40%.

The labor market is also expected to remain under

pressure. If current trends continue, Japan could face a

shortage of 6.3 million workers in 2030, according to an

estimate by Persol Research and Consulting.

See:

https://www.japantimes.co.jp/news/2025/06/04/japan/fertility-

rate-low/

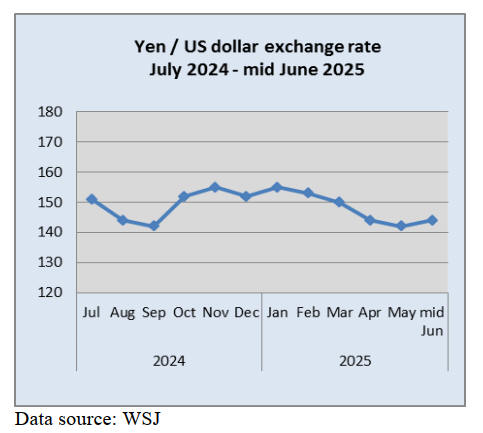

BoJ advised to continue with monetary tighteneing

The U.S. Treasury has suggested the Bank of Japan (BoJ)

should continue with monetary tightening in response to

domestic economic fundamentals including growth and

inflation to achieve “normalisation of the yen’s weakness”

and rebalance of bilateral trade.

The explicit mention of Japan’s monetary policy signals

the US focus on the BoJ’s ultra-low interest rate which is

seen as among factors that have kept the yen weak against

the dollar.

The US Treasury also said in its judgement no major US

trading partner was found manipulating its currency in

2024. But it said Japan, as well as China, South Korea,

Taiwan P.o.C, Singapore, Viet Nam, Germany, Ireland

and Switzerland, were on its monitoring list for extra

scrutiny.

The BoJ ended its massive monetary stimulus last year and

in January raised short-term interest rates to 0.5% given

the indications were that a durable 2% inflation rate was

possible.

The slow pace at which the BoJ is raising interest rates has

been seen by markets as a key factor keeping the yen weak

against other currencies.

See: https://www.asahi.com/ajw/articles/15825625

More than US$230 billion in M&A last year

With ample cash and trading at low valuations Japanese

companies are becoming more adept at defending against

rivals and activist investors who are showing renewed

interest in the country after decades of stagnant growth.

With changing attitudes on business expansion M&A is

expected to rise with analysts expecting a busier 2025 after

more than US$230 billion in M&A last year.

See:

https://www.japantimes.co.jp/business/2025/01/09/companies/ja

pan-ma-boom/

Japan, a leading contributor to the Africa Development

Fund

Cooperation between Japan and India is emerging as an

important dynamic in promoting development in African

nations. Representatives from the private sector,

government and academia gathered in Tokyo earlier this

year for a Japan-India-Africa Business Forum.

Marie-Laure Akin-Olugbade, Senior Vice President at the

African Development Bank, said Japan is a leading

contributor to the Bank’s Africa Development Fund which

extends assistance to 37 low-income nations in Africa.

She also mentioned Japan’s US$5 billion contribution over

the three years to 2025 to the Bank’s Enhanced Private

Sector Assistance for Africa initiative which funds

advances in electricity, connectivity, health, agriculture

and nutrition.

See: https://ps.asia.nikkei.com/jia2025/index.html

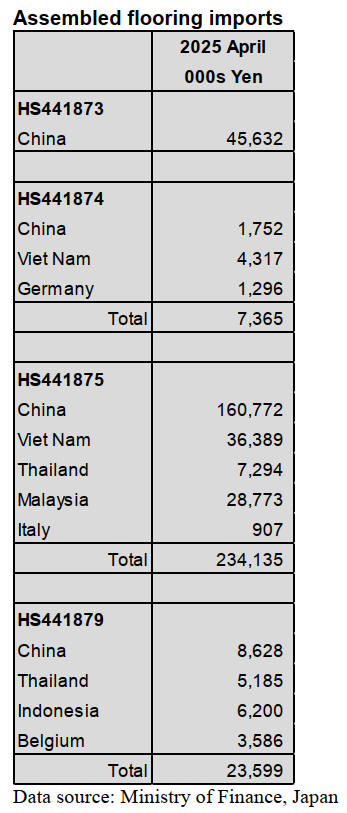

Import update

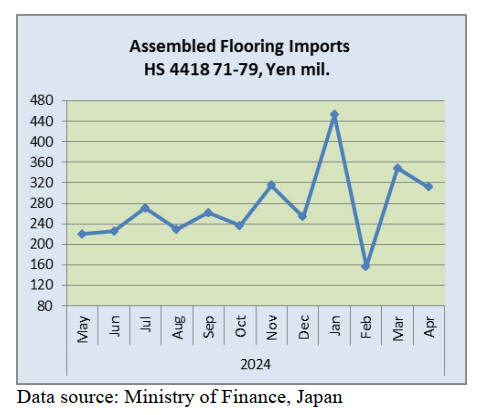

Assembled wooden flooring imports

The main category of assembled flooring imports in April

2025 was HS441875, accounting for 75% (62% in March)

of the total value of assembled flooring imports compared.

Of HS441875 imports, 69% was provided by shippers in

China, 15% by shippers in Viet Nam and 12% by shippers

in Malaysia. The other main source of assembled flooring

(HS441875) in April was Thailand.

The second largest category in terms of value in April

2025 was HS441873 (15% of the total in April) all of

which was shipped from China. The third and fourth

largest categories in value terms were HS441879 (8%) and

HS441874 (2%).

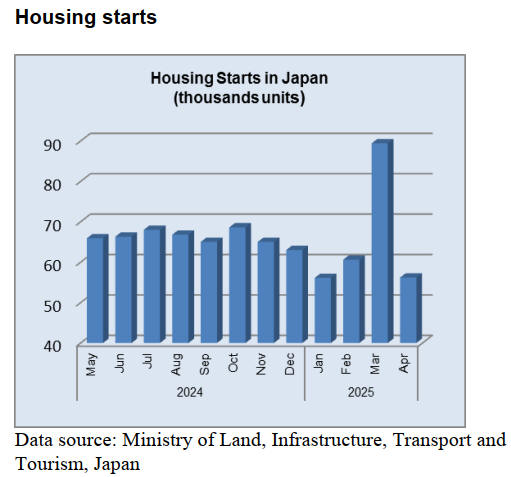

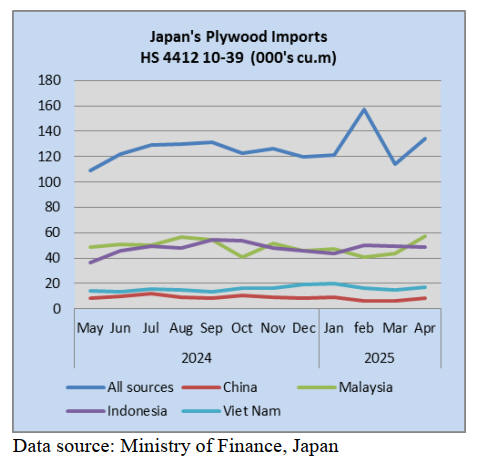

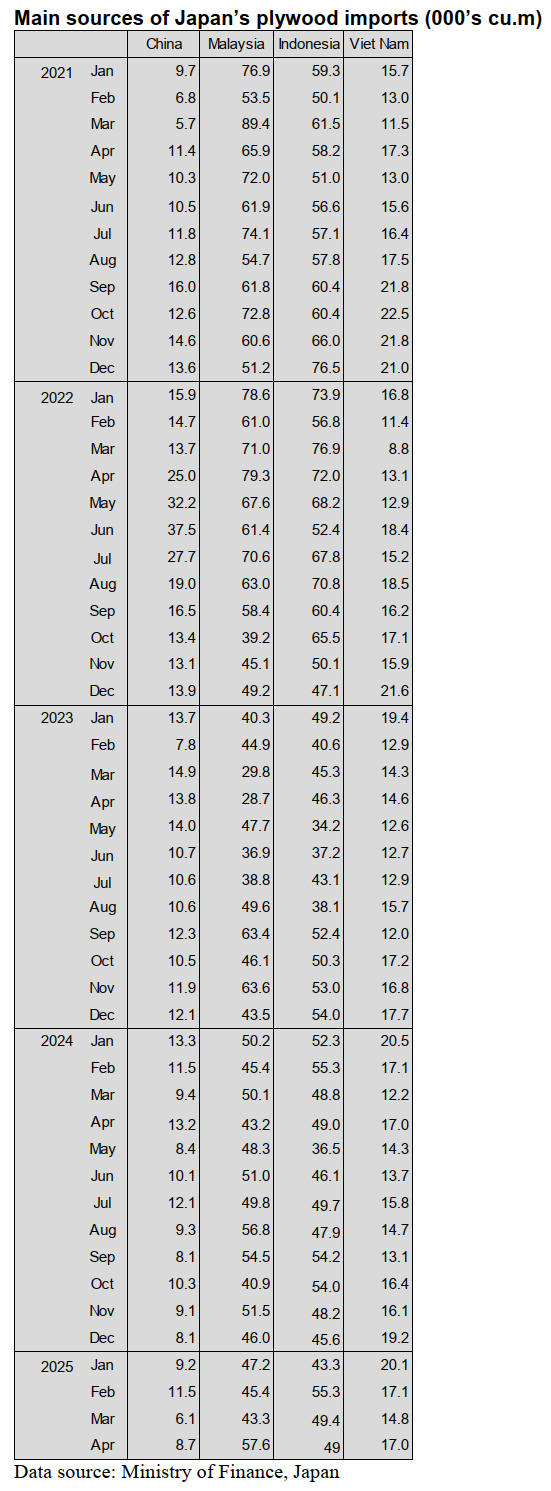

Plywood imports

As activity in the building and construction sectors gained

momentum in April demand for plywood increased. In

April 2025 arrivals of HS441210-39 were up 12% month

on month and also 8% higher than the arrivals in April

2024.

Malaysia and Indonesia were the top suppliers in April, as

in previous months. The volume of imports from Malaysia

rose slightly while the import volumes from Indonesia

were flat. Compared to past years, the volumes of plywood

imported into Japan have been steadily falling as more

plywood manufactures in Japan utilise domestic logs.

In April 2025 the other main shippers were Viet Nam and

China. Arrivals from China in April were down compare

to a month earlier while arrivals from Viet Nam were little

changed month on month.

As in previous months, of the various categories of

plywood imported in January 2025 HS441231 was the

largest (87% of total imports) followed by HS441233 and

HS441234 (5% each). The balance was of HS441239.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

First JAS certification for plywood in Viet Nam

United Forest Co., Ltd. became the first plywood plant in

Viet Nam to obtain JAS certification for plywood as of

the 5th May, 2025. Going forward, the company aims to

expand its customer base, targeting both building material

manufacturers and general distribution channels.

The JAS certification was obtained for standard plywood

manufactured at a plywood plant in Tuyen Quang

Province, Viet Nam, using all-layer Styrax Type 2. The

plant is able to produce medium-thickness standard

plywood that is commonly distributed in Japan.

Since all-layer Styrax has a white appearance and is

exceptionally beautiful, it was deemed easy to propose to

building material manufacturers using Chinese poplar

plywood, leading to the decision to obtain JAS

certification. The company started an operation at the

plant in the second half of 2023 and currently, 3,000 cubic

meters of plywood are being produced per month.

The majority of sales are directed toward factories of

Japanese furniture manufacturers in North America and

Viet Nam, with some sales also going to Japanese

building material manufacturers.

In addition to Styrax, the plant also uses Acacia and

Eucalyptus as raw materials. The plant also produces

birch plywood for the U.S. market and is capable of

complying with FSC certification requirements.

The LVL factory in Phu Tho Province, Viet Nam,

produces 2,500 cbms per month, with 2,000 cbms

allocated for the Japanese market. The plant has also

obtained JAS certification for LVL used in joinery

applications. Previously, there were two plants, but

operations were consolidated, leading to the closure of

one factory in the latter half of 2023.

In addition to considering an increase in production

capacity, the company is also planning a new LVL factory

within a nearby industrial park

The movement of South Sea a Chinese lumber is sluggish

due to low demand. Since the yen had appreciated against

the dollar in April, 2025 some companies had emerged

that is moving to secure only the necessary amount for the

immediate needs.

Furthermore, since mid-May, the exchange rate has shifted

back toward yen depreciation, prompting moves to secure

the necessary amount for immediate needs. Even though

the movement of goods is weak, there is still a certain

level of demand.

In Indonesia, orders for laminated boards from

manufacturers, which manufacture furniture for the U.S. in

Indonesia, decreased due to the additional tariff by the

U.S. government. It could also impact the sales approach

for laminated boards in the Japanese market.

Also, Chinese manufactures struggle with the same

situation. However, due to the persistently high prices of

raw materials such as Russian red pine, there is a strong

stance on maintaining the current pricing.

South Sea logs from Papua New Guinea have arrived as it

was scheduled in April, 2025. Demand and supply of

South Sea logs are balanced. Although the local weather

remains stable, the global demand for South Seas log

timber is slowing due to the deteriorating economic

outlook in China.

Logs destined for Japan are selected from high-quality

materials originally intended for China. Since the decrease

in shipments to China directly affects the supply to Japan,

concerns are being raised about its potential impact.

New wooden board - an alternative to tropical

hardwoods

Daiken Corporation in Osaka Prefecture announced that its

subsidiary, Daiken North America Ltd. in Canada, had

successfully completed the prototype of a new wooden

board that had been under development. It is expected to

be used as a baseboard for flooring, as an alternative to

tropical hardwoods and temperate broadleaf (birch)

plywood. Moving forward, the company plans to refine

the production line and improve quality with commercial

production scheduled for spring 2026.

The name of the new wooden board is “DIO woodcore”.

At the NWFA Expo, the largest exhibition in the wood

flooring industry, held in North Carolina, USA the

company showcased flooring samples made using this

product as the base material. It is said to achieve

performance equivalent to plywood in terms of bending

strength, wood screw retention and surface smoothness.

The material used is aspen one of the sustainable resources

native to Canada. Daiken North America is a manufacturer

of low-melamine decorative panels using particle board as

the base materia, with an annual production capacity of 7

million square metres.

Special feature, ‘Laminated lumber and CLT’

According to a survey regarding to production of

laminated structural lumber, which was held by Japan

Forest Products Journal in April, 2025, of the 42 valid

responses, 29 (accounting for 69%) indicated an expected

increase in production for 2025 compared to the previous

year (including those projecting the same production level

as the previous year).

Nine responses indicated a decrease compared to the

previous year, accounting for 21% of the valid responses.

This represents a four-point increase from last year's 17%.

Compared to last year, the shift in demand away from

imported laminated wood and competing Douglas fir

lumber has stabilised. In a demand environment where an

increase in housing starts is also unlikely, more

manufacturers are presenting a bleak outlook.

The production-related survey was conducted among 127

domestic laminated wood and CLT manufacturers

certified under JAS. Valid responses were received from

60 businesses, including 42 regarding laminated structural

lumber, 19 regarding laminated decorative lumber and 8

regarding CLT.

In 2024, the production volume of structural laminated

wood saw 15 responses indicating an increase compared to

the previous year (including those expecting the same

level as the previous year), accounting for 36% of valid

responses. This represents an 18-point decrease from last

year's survey result of 54%. Last year's survey responses

indicated that 81% of valid responses expected an increase

in production volume for 2024. However, it appears that

many manufacturers struggled more than anticipated to

achieve growth.

In the second half of 2023, the domestic inventory of

imported laminated lumber declined, leading to increased

demand for domestically produced products. Additionally,

from autumn onward, substitute demand emerged to

compensate for the shortage of Douglas fir lumber.

Additionally, manufacturers handling medium- and large-

section laminated lumber saw demand related to the

Osaka-Kansai Expo. These special factors supporting

demand continued until the spring of 2024. As the impact

weakened toward the summer, this change was reflected in

the survey results.

Regarding this year's production volume, 12 responses

indicated an expected increase compared to the previous

year (including those expecting the same production level

as last year). This accounted for 63% of valid responses,

marking a 21-point increase from last year's 42%.

In the survey on CLT manufacturers, 53 out of 59 valid

responses (accounting for 90%) indicated that some costs,

such as labor or logistics expenses, increased in 2024. 47

responses, accounting for 80%, indicated that the cost

increases would continue in 2025.

However, only nine responses indicated that the increased

costs had been passed on to product prices, with progress

ranging from 1% to 50%, highlighting the challenges of

price increases. Additionally, regarding logistics issues in

2024 beyond cost increases, nine responses indicated

difficulties in dispatching trucks due to shortages, while

three responses noted a reduction in transportation routes

for heavy goods and small-lot shipments.

In 2024, 42 manufacturers experienced an increase in

labor costs. The reasons for the increase were as follows:

12 responses cited base salary increases, 9 mentioned

regular wage increases, and 4 indicated workforce

expansion and measures against rising prices.

There were 44 responses indicating an increase in logistics

costs. The reasons for the increase were as follows: 19

responses cited higher freight charges, 6 pointed to the

2024 logistics issue, and 3 mentioned rising fuel prices.

There were 35 responses indicating an increase in

electricity costs. There were 42 responses indicating an

increase in adhesive costs. 18 manufacturers of structural

laminated lumber and CLT manufacturers responded that

lamina costs had increased. 15 responses indicated an

increase in log costs. For 2025, more responses indicated

that costs would remain flat compared to 2024. Eight

manufacturers of decorative laminated wood responded

that veneer and decorative sheet costs had increased.

The outlook for cost increases in 2025 was indicated as

follows: 39 responses for labor costs, 30 each for logistics

and electricity costs, 25 for adhesives, 22 for 22 for

lamina, 13 for logs, and 6 for veneers and decorative

sheets.

|